Bergabunglah dengan Bandar Togel Terpercaya untuk Kemungkinan Menang yang Lebih Tinggi!

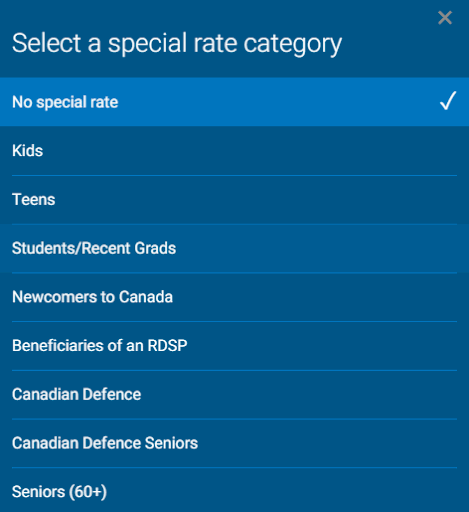

Bagaimana cara meningkatkan peluang menang dalam permainan togel? Bergabung dengan bandar togel terpercaya dapat menjadi langkah awal yang tepat. Dalam artikel ini, akan kita bahas tentang pentingnya memilih bandar togel terpercaya yang dapat memberikan keuntungan lebih tinggi bagi para pemainnya. Dengan akun togel terpercaya, Anda dapat merasakan kemudahan dan keamanan dalam bermain serta dapat menikmati fasilitas yang mempermudah proses taruhan.

Sekarang ini, dengan banyaknya bandar togel online yang bermunculan, menemukan agen togel terpercaya bisa menjadi tantangan tersendiri. Namun, dengan melakukan penelitian yang cermat dan mengevaluasi reputasi serta kualitas layanan dari berbagai bandar togel, Anda dapat menemukan bandar togel terpercaya yang dapat diandalkan. Menyaring agen togel berdasarkan lisensi resmi, ulasan pengguna, dan keberadaan layanan pelanggan yang responsif adalah beberapa faktor penting yang perlu Anda pertimbangkan sebelum bergabung.

Jika Anda masih ragu dengan bandar togel terpercaya yang ingin Anda pilih, cobalah mencari demo togel terpercaya yang ditawarkan. Dengan menggunakan demo togel, Anda dapat mencoba berbagai fitur dan sistem yang ada tanpa harus mempertaruhkan uang sungguhan. Ini memberikan kesempatan bagi Anda untuk menguji keakuratan sistem dan keamanan yang ditawarkan oleh bandar togel terpercaya sebelum Anda mulai bermain dengan uang asli.

Bergabung dengan bandar togel terpercaya adalah keputusan yang bijaksana untuk meningkatkan peluang menang Anda. Dengan mengamati lisensi resmi, ulasan pengguna, dan mencoba demo togel terpercaya, Anda dapat mendapatkan pengalaman bermain togel yang lebih menyenangkan dan merasa lebih yakin dalam menjalani setiap taruhan. Dalam artikel ini, kami akan mengupas lebih dalam mengenai manfaat serta langkah-langkah yang harus Anda lakukan dalam bergabung dengan bandar togel terpercaya untuk meraih kemenangan yang lebih tinggi.

Keuntungan Bergabung dengan Bandar Togel Terpercaya

Bergabung dengan bandar togel terpercaya memiliki banyak keuntungan yang dapat Anda nikmati. Dalam artikel ini, kita akan membahas beberapa keuntungan utama yang akan Anda dapatkan dengan bergabung dengan bandar togel terpercaya.

Pertama, bandar togel terpercaya menawarkan akun togel terpercaya yang aman dan terjamin. Dengan memiliki akun togel terpercaya, Anda dapat melakukan transaksi dengan nyaman dan tenang, tanpa perlu khawatir tentang keamanan data pribadi Anda. Bandar togel terpercaya juga menyediakan fitur keamanan yang canggih untuk melindungi informasi Anda dari ancaman yang tidak diinginkan.

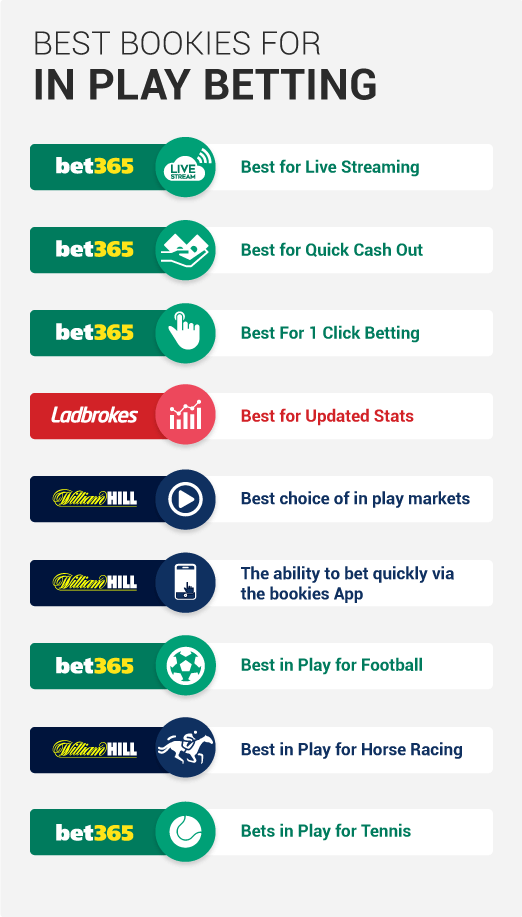

Kedua, bergabung dengan bandar togel terpercaya berarti Anda dapat mempercayai hasil undian yang diberikan. Bandar togel terpercaya menggunakan sistem yang adil dan transparan dalam melakukan undian. Dengan begitu, Anda dapat yakin bahwa setiap hasil undian yang diberikan adalah acak dan tidak ada campur tangan dari pihak lain. Ini akan memberikan Anda kepercayaan diri dan kepuasan dalam bermain togel.

Selain itu, bandar togel terpercaya juga menawarkan demo togel terpercaya bagi para pemain. Dengan adanya demo togel terpercaya, Anda dapat mencoba berbagai strategi dan metode permainan sebelum benar-benar berinvestasi dengan uang sungguhan. Ini memberikan Anda kesempatan untuk lebih memahami dan mendalami cara bermain togel dengan lebih baik sebelum terjun ke dalam permainan yang sebenarnya.

Itulah beberapa keuntungan bergabung dengan bandar togel terpercaya. Dari keamanan akun togel terpercaya, hasil undian yang dapat dipercaya, hingga adanya demo togel terpercaya untuk pembelajaran, semuanya dirancang untuk memberikan pengalaman bermain togel yang lebih baik dan peluang menang yang lebih tinggi. Jadi, jangan ragu untuk bergabung dengan bandar togel terpercaya dan menikmati keuntungannya!

Peran Agen Togel Terpercaya dalam Pengalaman Bermain

Sebagai pemain togel, memiliki akun togel terpercaya dan bergabung dengan agen togel terpercaya adalah faktor penting dalam mencapai pengalaman bermain yang optimal. Agen togel terpercaya memiliki peran yang krusial dalam melindungi kepentingan dan kenyamanan para pemain. Di bawah ini, kita akan menjelajahi tiga peran utama yang dimainkan oleh agen togel terpercaya dalam pengalaman bermain.

Pertama, agen togel terpercaya bertanggung jawab untuk menyediakan platform yang aman dan dapat dipercaya bagi para pemain togel. Mereka menginvestasikan waktu dan sumber daya untuk mengembangkan sistem keamanan yang canggih guna melindungi informasi sensitif pemain, termasuk detail keuangan dan data pribadi. Dengan memiliki akun togel terpercaya, pemain dapat memiliki keyakinan dalam bermain dan tidak perlu khawatir tentang kebocoran informasi atau penyalahgunaan data.

Kedua, agen togel terpercaya juga memastikan bahwa permainan yang disediakan adil dan transparan. Mereka menggunakan generator acak untuk menjaga integritas hasil undian dan meminimalkan kemungkinan manipulasi atau kecurangan. Dalam menjaga reputasi mereka, agen togel terpercaya tidak akan melakukan tindakan yang merugikan pemain. Para pemain dapat memiliki keyakinan bahwa peluang kemenangan yang mereka dapatkan adalah sejajar dengan undian yang dilakukan secara adil.

Terakhir, agen togel terpercaya sering kali menyediakan demo togel terpercaya, yang memungkinkan pemain untuk mencoba permainan tanpa harus mempertaruhkan uang sungguhan. Demo togel terpercaya ini sangat bermanfaat bagi pemain yang baru memulai perjalanan mereka dalam dunia togel. Dengan mencoba demo, pemain dapat mempelajari aturan permainan, memahami mekanisme taruhan, dan mengembangkan strategi tanpa risiko finansial. Hal ini memungkinkan pemain untuk memperoleh pengetahuan dan keterampilan yang diperlukan sebelum mereka mulai bermain dengan uang sungguhan.

Dalam merangkum, agen togel terpercaya memiliki peran penting dalam pengalaman bermain togel. Mereka menjaga keamanan dan kerahasiaan pemain, memastikan keadilan dalam permainan, dan menyediakan fitur demo yang bermanfaat. Apektogel Dengan bergabung dengan agen togel terpercaya dan memiliki akun togel terpercaya, pemain dapat meningkatkan peluang kemenangan mereka dan merasakan kepuasan yang lebih besar dalam bermain togel.

Manfaat Menggunakan Demo Togel dari Bandar Terpercaya

- Memahami Permainan Togel Secara Lebih Baik

Menggunakan demo togel dari bandar terpercaya akan memberikan Anda kesempatan untuk memahami permainan togel secara lebih baik. Anda dapat belajar tentang aturan permainan, jenis taruhan yang tersedia, dan berbagai strategi yang dapat Anda gunakan. Dengan demikian, Anda dapat meningkatkan pemahaman Anda tentang togel sebelum mulai bertaruh dengan uang sungguhan.

- Melatih Kemampuan Analisis dan Prediksi

Demo togel juga dapat membantu Anda melatih kemampuan analisis dan prediksi Anda. Anda dapat menggunakan demo togel untuk mengamati pola-pola yang muncul dalam permainan togel dan mencoba memprediksi hasilnya. Dengan melatih kemampuan ini, Anda dapat menjadi lebih baik dalam memilih angka-angka yang memiliki potensi untuk menjadi jitu.

- Menguji Strategi Togel Anda

Bagi mereka yang telah mengembangkan strategi togel, menggunakan demo togel dari bandar terpercaya dapat menjadi kesempatan untuk menguji strategi tersebut. Anda dapat melihat apakah strategi Anda berhasil atau perlu disesuaikan. Dengan menguji strategi Anda secara rutin melalui demo togel, Anda dapat meningkatkan peluang Anda untuk meraih kemenangan ketika Anda mulai bermain dengan uang sungguhan.

Dengan menggunakan demo togel dari bandar terpercaya, Anda tidak hanya dapat memperbaiki pemahaman Anda tentang togel, melatih kemampuan analisis, dan memperkuat strategi Anda, tetapi Anda juga dapat mulai merasakan antusiasme dan sensasi permainan tanpa harus mengambil risiko finansial yang tinggi. Bergabunglah dengan bandar togel terpercaya dan manfaatkan demo togel mereka untuk meningkatkan peluang Anda meraih kemenangan yang lebih tinggi!